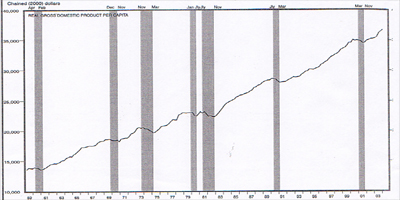

GROSS DOMESTIC PRODUCT

The money value of the total output of goods and services in one year. An accounting system has been constructed so that different elements of the economy, e.g., wages, profits, rent and interest payments may be tracked and summed. Business cycles may be traced by following growth rates of GDP. A recession occurs when the overall economy does not grow for two consecutive quarters of the year (e.g. July through December). Note the darkened lines in the chart indicating recessionary periods.